Differences in Quality of Life and Profitability on Small and Large Farms (1730– 1930): A Statistical Approach*

1930): A Statistical Approach*

Gábor Demeter

HUN-REN Research Centre for the Humanities

This email address is being protected from spambots. You need JavaScript enabled to view it.

Hungarian Historical Review Volume 13 Issue 3 (2024): 361-402 DOI 10.38145/2024.3.361

The competitiveness and productivity of large landholdings and small estates and the incomes or welfare of the people living on such estates have long been an important issue in the Hungarian historiography – and in everyday politics too. Based on the statistical evaluation of serial sources from the 18th, 19th and early 20th centuries we give a thorough analysis on the productivity of smallholdings and large estates, which showed a remarkable a spatio-temporal diversity contrary to the statements in the literature focusing on case studies or social aspects of the problems. The size of the investigated area (Kingdom of Hungary versus Hungary after 1920), as well as land-use colored the palette further. Statistical analysis also proved that socio-economic features on large landholdings were not so unfavorable as depicted by literature. There was a remarkable diversity within the large-estates regarding productivity too, and while in the 19th century their income/ha values were better, than the income on small estates, this gap partly disappeared between 1910 and 1935.

Keywords: Productivity, incomes, large estates, smallholdings, tenant peasantry, Kingdom of Hungary, 18th–20th centuries

Introduction

The competitiveness and productivity of large landholdings and small estates and the incomes or welfare of the people living on such estates have long been an important issue in the Hungarian historiography, and indeed this issue remains controversial today. That matter at hand is not simply an economic or social question. Rather, it is one of the means through which the various political regimes after 1848 sought to legitimate their rule and policies. Neither is this issue negligible from the point of view of contemporary regional research and territorial planning. In his discussion of peripheralization at the time of the regime change in the early 1990s Endre Miklóssy identified the preponderance of large estates, rural overpopulation, and the marginalization of livestock farming as three of the four main historical factors contributing to the alleged backwardness of the region today.1 Thus, the question can also be raised from the perspective of conditions today, or in other words, one could ask which former type of farm (allodial estates or farms dominated by plots) and social class (villages of former tenants with plots or villages inhabited by the landless, who after 1848 were mostly daily-wage agrarian laborers) are associated with areas which today are peripheral. The latter, the connection between the territorial pattern of social classes, and areas that are peripheral today, is not examined in the present paper.3In the interwar period, a political debate broke out on the issue of the comparative productivity of large versus small estates. Miklós Móricz (brother of the family writer Zsigmond Móricz) contended that large estates were more productive, but these estates were also associated with poorer living conditions for the populations living on them (and he supposed a causal relationship between the two).2 Jenő Czettler pointed out the advantages of the large estates from the perspective of productivity—in the interwar period, because large estates had 20 percent better grain yields and 30 percent better yields for potatoes than small estates.3 Mihály Kerék refuted this. He contended that livestock production on smallholdings (which most statistics do not measure) compensated for the advantages of large holdings in grain production4 (and net cadastral land income)5 per acre. A table comparing the Balkan countries in the volume by Zagorov, Végh and Bilimovich, which was published after World War II, shows that in Hungary and Romania (as opposed to Greece, which also had a polarized estate structure) the yields of large estates were 20–30 percent higher than the yields of small estates in terms of grain production.6 However, Tibor Tóth’s research on the Interwar period, which is limited to the Transdanubian region, shows that the yields were better on smallholdings, although the return rates were somewhat slower.7 The issue is not a specific Hungarian problem. According to Yanaki Mollov, Bulgarian smallholdings had better yields per hectare than the large estates in the interwar period.8 However, this is not the case if per capita values are calculated (labor force), and small farms were much more vulnerable to climate variability and changes in the external economic situation (including price volatility, which became an acute crisis after 1929).

The profitability of a given estate type may well have depended on many factors, including type of land use, land quality, location of the sample area, and the availability of technological advances, all of which are examined in the present study. Even the proclivities of political regimes (i.e. legal measures) may have been helpful in many cases (for instance in the case of Ottoman Macedonia in the nineteenth century or in dualist Hungary). However, there are also examples when state intervention was not beneficial (for instance the permanent agrarian crisis in Serbia and Bulgaria after 1870, which was due to the maintenance of smallholder peasant democracy). Productivity and profitability also varied over time. There are many ways to measure these changes, but they do not always produce the same results.

If our results show that productivity measured according to harvest yield per acre was better on large estates then we need to consider the possible reasons for this, which include the following: (a) plot size, parcel size, parcel numbers, (b) technological development, (c) land use and product structure of the smallholdings and large estates, (d) whether the nobility managed to acquire better quality lands after 1848, or (e) whether the landed gentry, losing their tax exemption after 1848, attempted to manipulate the cadastral land survey during the registry period (1851–1865), when land income became the basis for land tax (1865), thus reducing their land tax by claiming that their lands were of poor quality. Klára Mérey, Pál Sándor, and Lajos Für have given concrete examples of how large landowners acquired fallow land after 1848 that had formerly been used by the peasants.9 They have also shown, furthermore, that these lands were often of better quality than the plots remaining in peasants’ hands.10 Scott M. Eddie, however, argues that this was not a general trend in 1850–1870. His sophisticated cliometric studies using country-scale data support the hypothesis that large estates (more precisely, the estates owned by the aristocracy) were subject to a more favorable tax classification than might have been expected in only one county out of the 52 studied (see the case of Viharsarok, also analyzed here).11 The peasant estate was also sometimes placed in a higher “golden crown” category because it had a higher proportion of ploughland, even if the soil quality was actually worse because peasants were forced to cultivate more arable lands regardless of quality (see the case of Békés County in the discussion below).12 On the other hand, the proportion of land taken up by pastures and forests was sometimes higher on large estates, and because of their generally lower income per acre, the average cadastral income per hectare on the whole large estate was also lower compared to the peasant farms, which were primarily ploughland. (The Draskovich family’s estates in southern Baranya offer an example of lands with a higher proportion of pastures and forests, while the Benyovszky family’s estates in the same area were primarily ploughlands).13

Productivity in the 18th Century

In the discussion below, I offer an overview of the issue by providing a summary of research done between 2018 and 2023. According to the census of 1728, which survived in 11 counties (2,200 settlements),14 the declared (and this word is important) seed yield (measured in proportion to seeds sown)15 on serf plots was not more than 1:2 in 25 percent of the settlements (500 settlements), and a seed yield of 1:4 or more was measured in only 20 percent of the settlements. (If the output is calculated in cubulus before sowing and harvesting and paying the tithe and state tax, a grain output of 1 to 4 was close to 800 kg/ha). The average yield of 1:3 was exceeded in Heves, Nógrád, Tolna, Sopron, and Szabolcs Counties. The lower-than-average value in Bihar and Szepes Counties, which are mountainous and forested, is not surprising, while the below average yield of Pest County is more surprising (animal husbandry still dominated the central plains in the eighteenth century due to the devastation caused in 1541–1699 during the Ottoman era). The declared yields of the municipalities of Somogy, Zala, and Vas Counties were also below 3:1. As 10 of the 11 counties are located in present-day Hungary (which is mostly lowlands), data from counties for which the sources do not provide these figures probably would not meaningfully raise this 1:3 average.16 As the landlords and the Church each took 10 percent of the harvest and 33 percent of the harvest had to be spared as seed for the next year, this 1:3 ratio allowed peasants to keep only 47 percent of their harvest, and part of this had to be used to pay taxes to the state. Thus, in the end, not more than 30 percent remained for peasant consumption. Supposing that 200 kg of grain are required for one adult and 150 for one child every year as a minimum, this makes total human consumption for a family 1,000–1,200 kg17 (without animals). This cannot be more than 33 percent of the total grain produced, ranging from 3,000 to 3,500 kg (otherwise the taxes cannot be paid). Calculating with a general output ratio of 1:3, this means that 1,000–1,200 kg of seed had to be set aside to be sown for the next year. Land size was calculated in cubulus, which indicates the volume of seed, 92 kg18 for a Hungarian acre (1 cadastral acre equals with 5,570 sq m, 1 Hungarian acre is 4,200 sq m). Thus, 11 to 12 acres (4.5 to 5 ha) had to be sown to produce this amount of grain at an output ratio of 1:3 in order to secure the subsistence of a family. In the case of an output ratio of 1:5, the seed set aside for the next year was 20 percent of the total harvest, taxes paid to the landlord and the Church came to a total of 40 percent, leaving 60 percent for the peasant to use to feed his family and pay the royal taxes. This left him with more than 40 to 45 percent of his harvest after taxation. Thus, even a smaller plot under 10 acres could sustain a similar family of six according to the figures used above.

To obtain more land, peasants could change the field-system and increase the ratio of cultivated lands from the usual 50 percent (the remainder 50% was used as fallow or grazeland) in the two-field system to 67 percent by applying three-field system (using one third of the plot for autumn crops, one third for spring crops and one third as fallow in a rotational system). They could also rent land from the landlords. This three-field system was often used in hilly regions in 1728 to compensate for lower soil quality.19 Applying the three-field system in the 18th century was not necessarily the sign of modernization or relative welfare (crop surplus), as plots using three-field system were not more productive, than lands under two-field system. It was rather a response to challenges caused by relative land shortages.

In 1728, the larger plots (sessio) had proportionally smaller yields per acre than the smaller units of land. In the lands with poorer yields, the plots tended to be larger, both in absolute terms (sessio size) and measured per capita. Had this not been the case, the population would have been compelled to move. (More than 60 percent of tenant peasants worked lands that were less than half a plot. This is a clear indication of the progressive fragmentation of the lands.) In his research on the Székely Land in the early eighteenth century,20 Dezső Garda has shown that there was no significant difference in the grain yield of the armalist noblemen (nobles without peasants), the tenant peasants, and the landless cottars. The yields fluctuated around nine of ten kalangya.21 The differences between social groups were more pronounced in terms of livestock (1.9 and 3.7 cattle per family for cottars and members of the petty nobility, respectively). Most of the large estates were basically engaged in livestock farming in the first decades of the eighteenth century, either because of the general demand in Europe or because of labor shortages. Before the unification of peasant duties in 1767, the number of days spent on in corvée (compulsory work on a landlord’s manor) or the geographical location of the manor may be a guide to the nature of the large estates (allodia). Vast landholdings that made little use of corvée or allowed tenant farmers to free themselves of this obligation by making payments instead were more likely to be livestock farms (as these required less labor force thus were unable to exploit corvée efficiently), while near the larger cities (Vienna, Buda) grain production began to spread, and this required a workforce. This also suggests that the grain farming methods used on large estates may not have been very efficient in the beginning of the eighteenth century.

As eighteenth-century cadastral census data survived along the valley of the Tisza River, they can be used to quantify the share of tenant peasant plots compared to large estates, as well as to compare the yields on peasant plots and large manors at the end of the eighteenth century (Figs. 1 and 2). In contrast to Jászság and Nagykunság, the Tisza floodplain (and the Hevesi plain) was dominated by manorial ploughlands in 1786. This had not changed even in 1865, when water regulations were introduced and cadastral surveys were made to document the boundaries of estates and tenant plots.22 In the Central Tisza floodplain, both in regional comparison and also on the smallholdings, the grain yield per acre was lower than in Nagykunság and the plains of south Heves, for instance, and more land was owned by the lords and more crops were appropriated by the nobility (Table 1), whereas the amount of land per one agricultural inhabitant (including the cottars) was the smallest.23 On the other hand, at the end of the eighteenth century, there was hardly any measurable difference between the yield per acre of small and large landholdings according to the surviving cadastral data. In terms of the total area of large holdings and plots, there were hardly any settlements on the Central Tisza floodplain, in the Békés loess and Nagykunság, and in South Heves which did not reach the limit of self-sufficiency (nine pm24/person or five pm without animals) calculated by Glósz, with the exception of the region of Kiskunság (Danube-Tisza Interfluve, and in this area there was still heavy emphasis on animal husbandry on the large, empty quicksand plains) and Dévaványa in the moorland of Sárrét. Here, therefore, self-sufficiency had to be achieved either through animal husbandry or other forms of work (cottage industry, migrant labor). However, if we deduct the production of large estates from the total regional production, the situation was not good elsewhere either. Along the Tisza River (in contrast to the settlements of the Nagykunság or southern Heves), the yield was often barely 5 pm per person for peasant plots, if landless cottars are included and the yields of large holdings are not added (Table 3). Thus, the landless cottars25 were forced to work either on the large estates or in animal husbandry (either as owners or herders) in the late eighteenth century. As long as there was enough common grazeland (this was the case until the beginning of great water regulation works in the late 1840s), the livelihood of this stratum was assured. However, the expansion of the large estates (and private land in general) over the commons and the expansion of ploughing on the large estates at the time of the river regulations26 eliminated their livelihood and also provided the large estates with a cheap labor force that was no longer self-sufficient and thus could be easily exploited. This class was the biggest loser of the water regulations works and the new laws on land property after 1848. (The former common lands fell into the hand of landlords after 1848, who, prompted by the European grain hunger after the great crisis in 1847, began the transformation of even lower quality lands to arable land. These lands were profitable until grain prices collapsed after 1873).

According to Glósz, one or two sown cadastral acres were usually enough for one person to subsist, and since the amount of arable land per tenant peasant in most of the floodplains reached ten to twelve acres in the beginning of the nineteenth century, families of five to six people were able to live off the land at the time. By 1910, however, even with the increase of cultivated lands due to water regulation, only an average of six sown acres was available per family, which could only be sufficient for a family of this size if yields doubled (to twelve pm/acre, or about one ton/ha).

It is also important to underline that the yields of the arable land of the landlords in the Central Tisza floodplain were not good, and water regulation resulted in the further expansion of these low-quality ploughlands.27

Table 1. Differences in grain productivity of Hungarian lands based on the specific variables extracted from the data of the first cadastral survey in the 1780s

|

Landscape-type |

Ploughland as a proportion of the |

Meadow and pasture as a proportion of the total % |

Share of manorial ploughland (and yields) % |

Ploughland, total |

Peasant plot acre/person |

Total grain output/person (in pm) |

Yield of manorial land (pm/ acre)28 |

Yield of peasant plots |

Yield for one peasant |

|

Western Hungary: Győr, Moson, Sopron (71)29 |

30.43 |

60.19 |

41.50 |

1.88 |

1.05 |

13.15 |

7.04 |

7.02 |

8.48 |

|

South Heves (32) |

48.16 |

43.82 |

52.98 |

2.35 |

1.13 |

17.68 |

7.48 |

7.28 |

7.74 |

|

Tisza floodplain (31) |

20.42 |

78.19 |

58.89 |

1.81 |

0.77 |

12.57 |

7.16 |

7.27 |

5.10 |

|

Hills of North Heves (39) |

34.24 |

25.89 |

52.15 |

2.03 |

0.77 |

12.02 |

5.88 |

5.96 |

6.28 |

|

Nagykunság plains (12) |

24.52 |

71.04 |

28.36 |

1.87 |

1.34 |

17.17 |

9.16 |

8.76 |

12.01 |

|

Csongrád County (3) |

24.74 |

74.11 |

23.56 |

1.77 |

1.62 |

15.37 |

9.55 |

8.67 |

11.88 |

|

Jászság (11) |

49.34 |

47.27 |

3.61 |

3.40 |

1.85 |

10.87 |

5.40 |

5.42 |

10.48 |

|

Kiskunság sand dunes (8) |

30.40 |

67.80 |

10.63 |

4.15 |

1.88 |

10.08 |

4.85 |

5.17 |

9.35 |

|

Altogether (216) |

30.73 |

61.46 |

37.72 |

2.15 |

1.18 |

13.71 |

6.90 |

6.86 |

7.95 |

|

Source: Calculations based on raw data published by Dávid, “Magyarország első kataszteri felmérése” and Rózsa’s recent explorations, Rózsa, “Az ártéri gazdálkodás mérlege.” |

|||||||||

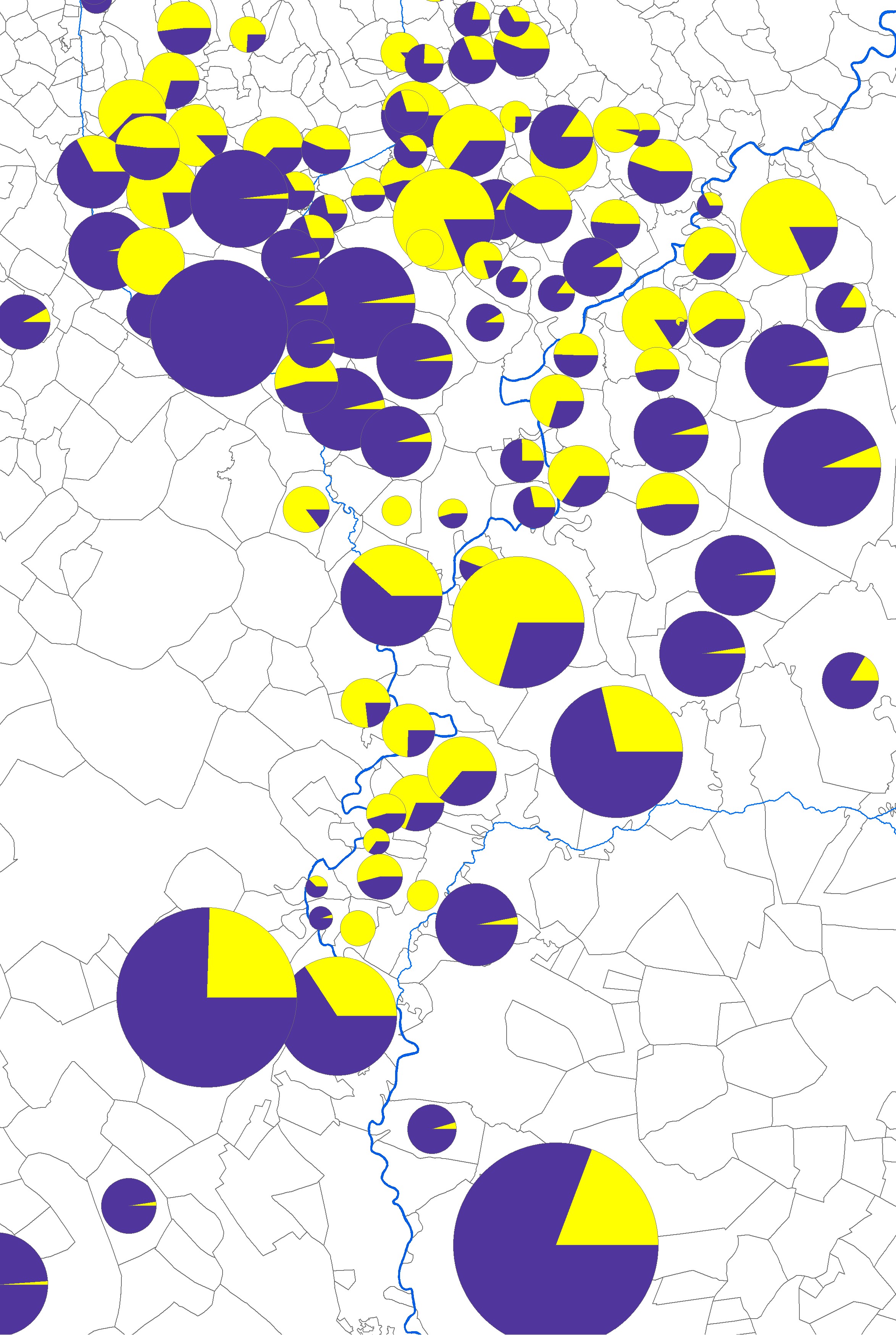

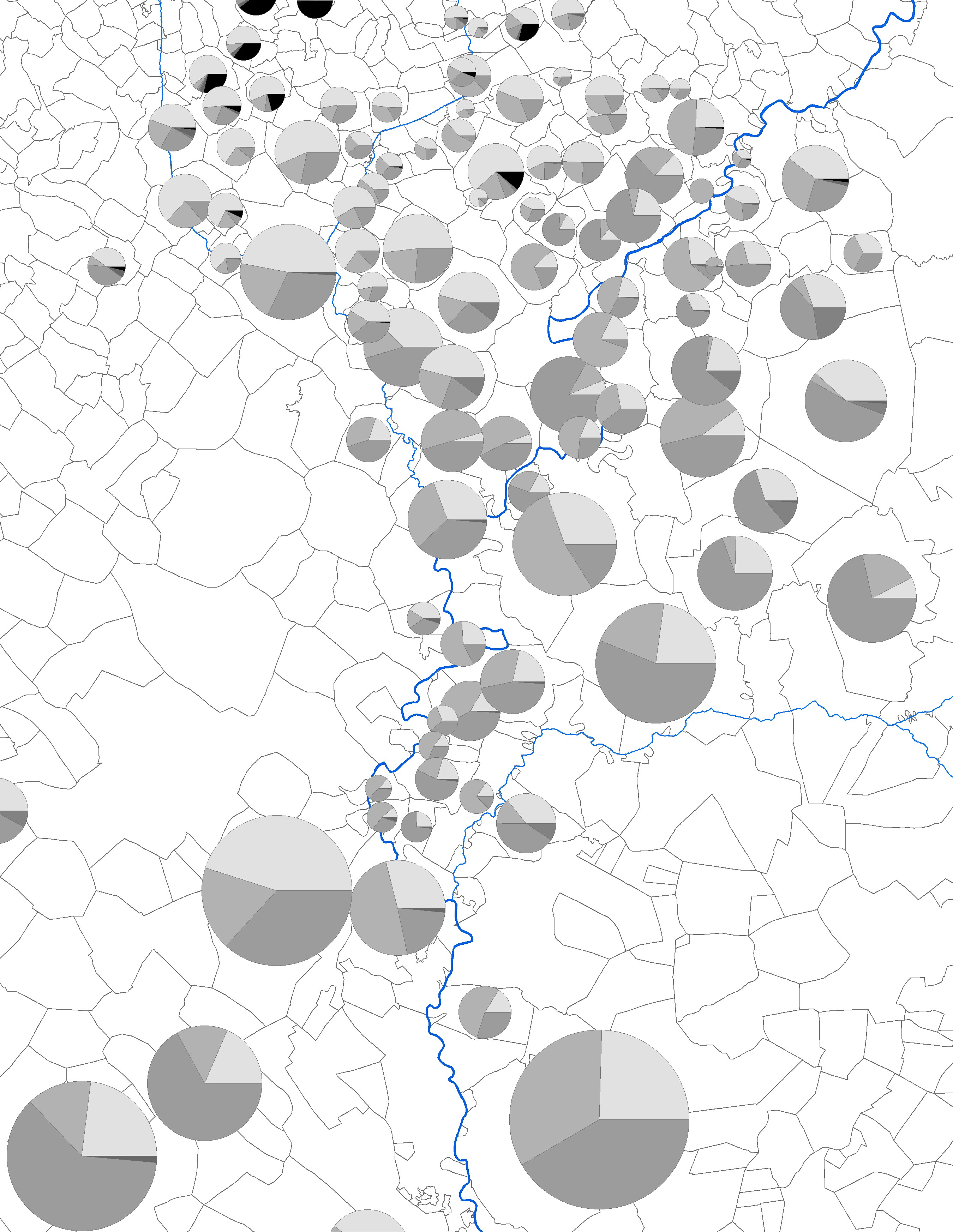

Figures 1–2. The size and proportion of manorial arable land (light grey) in the surviving material of the 1786 cadastral census (based on Dávid, “Magyarország első kataszteri felmérése” and Rózsa’s recent explorations, Rózsa, “Az ártéri gazdálkodás mérlege.” / Regional differences in the land use of total cultivated land in 1786 based on the cadastral census (light grey for ploughland, medium grey for meadow and pasture, dark for garden and forest). There was hardly any arable land in the settlements of the Tisza floodplain, which were characterized by small administrative areas and large (manorial) estates with high share of the available arable land.

Productivity of Smallholdings and Large Estates from the 1860s to 1910

The significance of the data series published in 1865 during the first surviving cadastral survey30 is that it is available for the whole country (except Transylvania and the large towns). To a limited extent it also makes it possible to calculate the net cadastral incomes31 of large and small estates, since the number of settlements where only smallholdings or only large estates were recorded (the data for so-called puszta, or “plainland farmsteads,” which had only one or two owners, were recorded separately) was statistically relevant. (Where both large estates and smallholdings were present, we cannot calculate their incomes separately.) From Table 2, it is clear that in the 1860s (after the abolition of corvée), the large holdings were more productive (in terms of harvest yield per acre) than smallholdings. Smallholdings had harvests per acre that were only 66 percent of the harvests (measured per acre) of the large estates.

Table 2. Differences between the profitability of small farms and large holdings in Hungary in 1865 (net cadastral income, excluding the production of livestock)

|

Indicator |

Small farms (sample) |

Large landholdings (sample) |

Large estates with some small farm |

Country total and average** |

|

Number of holdings |

126,758 out of 2,010, 000 |

187 out of 23,685 |

138*+235 |

2,034,630.0 |

|

Total utilised area (acre) |

1,380,000.0 |

409,000.0 |

131,487.0 |

33,510,620.0 |

|

Net cadastral income (forint) |

3,610,000.0 |

1,944,000.0 |

599,600.0 |

98,056,000.0 |

|

Average size of holding (acre) |

10.9 |

2190.0 |

1000.0 |

16.5 |

|

Average net income per holding (forint) |

28.5 |

10,395.0 |

4500*.0 |

.048.2 |

|

Net income per 1 acre (forint) |

2.6 |

4.7 |

4.6 |

2.9 |

|

Proportion of area used |

92 |

80.0 |

95.0 |

91.0 |

|

Study sample |

6.2% of farms, 4.1% of land, 3.7% of income |

1.1% of farms, |

0.4% of land, 0.6% of income |

100 |

|

** Counting only large estates. |

||||

Were the differences in income between small and large estates due to technological differences, or were they rather due to the fact that after the reforms in 1848, the nobility acquired land of better quality?32 Followers of prominent twentieth-century Hungarian historian Gyula Szekfű argue, on the basis of parcel names, that the large landowners established their estates on land cleared and cultivated in the nineteenth century and not on parcels obtained from peasants. This land therefore cannot have been of a terribly high quality and cannot have yielded impressive harvests or large incomes (and therefore there was no need for the landowners to manipulate the data). The results given above, however, seem to contradict Szekfű’s idea, though only partially. Surprisingly, if we approach the data series in a different way, in 1865, smallholdings were overrepresented in settlements with a high net cadastral land income of over six forints33 per acre (323,000 holdings, or 15 percent of the smallholdings, compared to 2,635 large holdings, or 10 percent of the large estates).34 This seem to support Szekfű’s thesis (according to which the land quality of the large holdings was generally poor). However, since the distribution of landholdings within a settlement (and therefore the difference in their soil quality) is not known, these data are not conclusive.35 At the other extreme, for the settlements with a low net income of one or two forints per acre (below average), we counted 6,630 large estates and 466,000 small farms in total, which is 28 percent and 23 percent, respectively. Here, large estates are overrepresented, but this is also due to large forest estates with poor yields (this is immediately clear if one plots the large estates on the map).

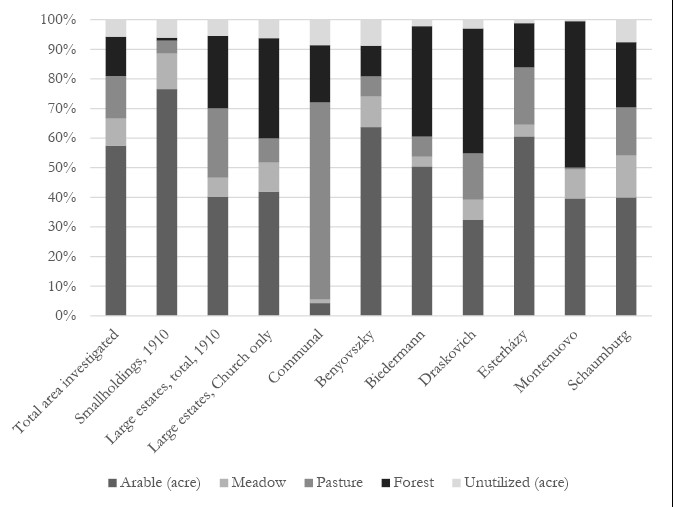

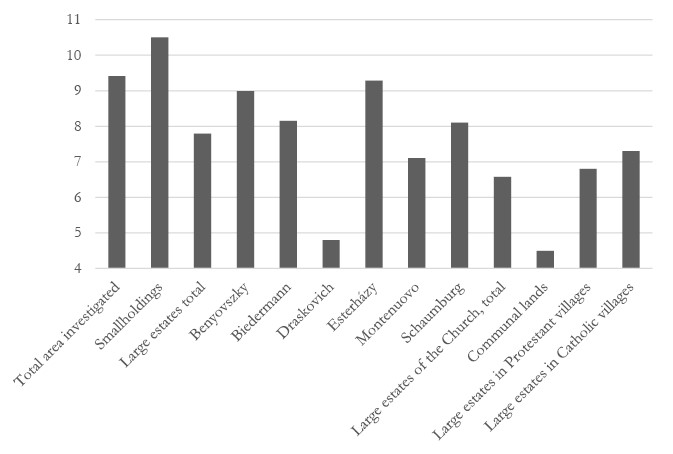

In other words, the dominant land use of the estate types has a strong influence on the incomes/acre expressed in money. Despite the low group average in the sample in Table 2, smallholdings were not characterized by uniformly low productivity. In Baranya in 1910, for example, smallholdings did not yield worse net cadastral incomes per acre than the larger holdings, because the smallholdings had a higher proportion of arable land, which had higher net cadastral incomes than forests, meadows, and pastures, and this increased the weighted average of the net income per plot.

The notion that, after the 1875 tax reform, when cadastral net income became the tax base, the tax system favored large estates and the taxes placed on smallholdings were higher in absolute terms is untenable. In 1910 (the investigation was reduced to the recent territory of Hungary due to the availability of data), the direct tax36 per capita in settlements dominated by large estates was 20 kronen (30 K for the large estates of aristocrats), and in settlements dominated by small estates it was 15 K (in the national territory of Hungary today).

Figure 3. The differences in land use depending on estate types in two districts of Baranya County in 1910 (Demeter and Koloh, “Birtokstruktúra és jövedelmezőség.”

Figure 4. Net land income per cadastral acre in kronen (K) in different subsets of two districts of Baranya County (Ormánság and Hegyhát), 1910 (Demeter and Koloh, “Birtokstruktúra és jövedelmezőség.”)

Table 3. The difference between the net cadastral income per acre of a large estate (over 100 cadastral acres) and the total settlement average and its relationship to the land use-types on the former Harruckern estate 1857–1865 (selected cases)

|

Landholder |

Location (settlement) |

Arable |

Meadow and garden |

Vineyard |

Pasture |

Large estates in total (in acre) |

Net cadastral income, |

Net cadastral income per acre on large estates |

Net cadastral income per acre on total area of the settlement |

Share of arable land on large estates in % |

|

Count György Apponyi |

Orosháza Kis-Csákóval |

633 |

1 |

680 |

1,316 |

6,125 |

4.65 |

5.49 |

48.10 |

|

|

Count György Apponyi |

Csaba |

3,353 |

1,020 |

20 |

1,166 |

5,561 |

32,099 |

5.77 |

6.25 |

60.29 |

|

György Bajzáth |

Szentetornya |

608 |

64 |

63 |

736 |

5,802 |

7.88 |

82.61 |

||

|

Dániel Bakai |

the peripheries of Csaba |

61 |

43 |

1 |

6 |

113 |

608 |

5.38 |

6.25 |

53.98 |

|

József Bartóky (abarai és bartóki) |

the peripheries of Csaba |

76 |

12 |

46 |

135 |

807 |

5.98 |

6.25 |

56.30 |

|

|

Count László Batthyányi |

Csákói-puszta, Csaba, Kondoros |

3,912 |

10 |

255 |

4,178 |

34,205 |

8.19 |

6.25 |

93.63 |

|

|

Baumgarten brothers |

Orosháza |

1,216 |

144 |

582 |

1,942 |

11,074 |

5.70 |

5.49 |

62.62 |

|

|

István Beliczey |

the peripheries of Csaba |

334 |

3 |

338 |

2867 |

8.48 |

6.25 |

98.82 |

||

|

József Beliczey |

Csaba határában |

103 |

103 |

622 |

6.04 |

6.25 |

100.00 |

|||

|

Rudolf Beliczey |

214 |

6 |

220 |

1,850 |

8.41 |

97.27 |

||||

|

József Bernrieder (Paks) |

Orosháza |

327 |

12 |

340 |

2,853 |

8.39 |

5.49 |

96.18 |

||

|

… |

||||||||||

|

Antal Wenckheim |

1,456 |

337 |

28 |

1,822 |

10,286 |

5.65 |

6.25 |

79.91 |

||

|

Baron Béla Wenckheim |

Csaba |

1,103 |

1,103 |

6,624 |

6.01 |

6.25 |

100.00 |

|||

|

Mrs József Wenckheim |

Csorvás |

435 |

435 |

2,602 |

5.98 |

5.71 |

100.00 |

|||

|

Károly Wenckheim |

Csorvás |

310 |

310 |

1,861 |

6.00 |

5.71 |

100.00 |

|||

|

Rudolf Wenckheim |

Csorvás |

489 |

489 |

2,938 |

6.01 |

5.71 |

100.00 |

|||

|

Baron Viktor Wenckheim |

Csorvás |

163 |

163 |

979 |

6.01 |

5.71 |

100.00 |

|||

|

Móric and Albert Wodianer |

Gyoma |

2,599 |

4,201 |

3 |

3,141 |

9,945 |

27,647 |

2.78 |

3.42 |

26.13 |

|

Móric and Albert Wodianer |

Csorvás |

723 |

723 |

4338 |

6.00 |

5.71 |

100.00 |

|||

|

Estates between 100–500 cadastral acres are given in italics. The highlighted background indicated large estates with net incomes higher than the overall municipal average and estates where the share of arable land was above 80 percent. See footnote 40 for source information. |

||||||||||

The same is true if we use per acre values instead of per capita. The average tax for settlements without large estates was 6.5 K per acre, and the average tax for settlements dominated by estates owned by the petty nobility was the same, whereas for villages dominated by aristocratic estates it was 7.3–8 K per acre. Since direct taxes also included land tax alongside a household tax and corporate and industrial taxes, the tax values are also indicative of income conditions. Thus, the hypothesis that large estates paid less tax per acre because the nobility used its political influence to manipulate taxation to underestimate the value of their land in the golden crown system is not tenable in general either. In fact, they did not pay less, as proved above, and Eddie’s aforementioned thesis (that large estates in general did not enjoy more favorable tax rates between 1850 and 1870) seems persuasive.37

Mariann Nagy also concludes that the higher the share of smallholdings in a county, the lower the net cadastral income (r= -0.39).38 Our own country-level (within the state boundaries of Hungary after 1920), settlement-scale study confirms that in the villages dominated by large holdings, net cadastral income per capita (27.8 vs. 21 K) and, to a lesser extent, net cadastral income per acre (10.5 vs. 8.6 K) were also higher in 1910 than in settlements dominated by smallholdings. However, by 1935 the difference had almost disappeared. Thus, this phenomenon showed significant dynamics within two generations!

For the mid-nineteenth century, another case study gave new information concerning the productivity of large and small estates. In 1857, several censuses of the former Harruckern estates (today Békés County in southwestern Hungary) were recorded,39 and here the net income per acre (in forints) can be calculated for more than 80 large estates. Since we also know which settlements these large estates were located in, their net incomes could be compared with the average land incomes of the total municipality (which includes small farms) in 1865. The resulting picture is rather chaotic, because the net cadastral income per acre of large farms varied between five and nine forints/acre, and in some cases the net cadastral income per acre of large landholdings was lower than the overall municipal average. Since this was not owing to differences in the sizes of large farms, we also examined the role of land use. Interestingly, large farms were more profitable than small farms if the share of ploughlands exceeded 75 percent of the area of large farms. (This implicitly also means that the large estates might have had better soil quality, at least for grain production, since it was the large estates that offered a viable way of expanding arable land up to 90 percent of the whole). When the share of ploughlands was between 60 and 70 percent, the net income per hectare of the large farms was equal to the average net income of the municipality, and below this percentage value, the small farms were more profitable (Table 3). Large farms were therefore more competitive in the case of monocultural farming.

Leaving aside land quality and land use as factors and focusing only on the size of the landholdings, in the 42 settlements analyzed in Békés, Csongrád, and Csanád Counties, the large landholdings had 25 percent higher net incomes per acre than the small landholdings in 1865 (Table 4), confirming the result of our general survey for 1865 but contradicting the results of the investigation of the 80 large estates above (Table 3). However, as before, we were unable to quantify the role of animal husbandry, so we cannot estimate how it would modify the differences. Net cadastral income, as an indicator, allows us to determine neither where the income/expenditure ratio was better (i.e. which estate type was more efficient) nor where the expenditures were lower (i.e. which landholding size was less capital intensive), since no other indicator is available at the settlement level beside the “income minus expenditure value” (i.e. net cadastral income).40

Table 4. Differences in net cadastral incomes of smallholdings and large estates (1865) on the area covered by the genetic soil map of Békés County (1858)

|

Dominant farm structure |

Net cadastral income |

Net income |

Average estate size |

|

|

Mixed (25) |

Avg. |

4.30 |

135.0 |

31.40 |

|

Smallholdings dominate (5) |

Avg. |

4.24 |

61.1 |

14.44 |

|

Large estates dominate (12) |

Avg. |

5.43 |

29846.0 |

5494.31 |

|

Total number of settlements |

Avg. |

4.45 |

8615.6 |

1933.97 |

Using a special source, however, it is possible to examine how land quality affected income and determine whether large estates were located on better land or not in these three counties. Table 4 above is based on the cadastral survey conscription published in 1865, which includes the precise, accurate number of large and small estates (but not their size separately) and the number of “puszta.” A genetic soil map of the area (the second oldest in Europe) from 1858 has also survived. By superimposing the administrative boundaries of 1865 (Figure 5) on the soil map using GIS-techniques, one can identify the dominant soil type per settlement, and the settlement level average values for net cadastral income per acre in 1865 can be compared to the soil types. Net cadastral income per acre and per holding was highest in the loess (Table 5), which also suggests that the loess was dominated by large estates, while in contrast, the sand or the saline solonetz soils (vertisols) were dominated by small estates in 1865. The net cadastral income per acre on smallholdings located on sands was good, while the incomes of small farms established on peat and solonetz soils was poor. Settlements with mixed saline-loess soils were also dominated by large estates, but with better income per acre values. In other words, the large estates were mostly located on better soils.

Table 5. Net cadastral income per acre and per holding (in forints) by soil type and average size of holdings by soil type in 1865

|

Soil type and |

Net cadastral income |

Net cadastral income |

Average estate size |

|

|

sand IV (1) |

Avg. |

5.49 |

97.38 |

17.74 |

|

peat (2) |

Avg. |

2.38 |

103.25 |

43.36 |

|

loess I (8) |

Avg. |

5.91 |

2,3076.77 |

3,903.40 |

|

salty/saline II (14) |

Avg. |

3.51 |

1,811.74 |

516.68 |

|

salty and peat (1) |

Avg. |

2.32 |

68.75 |

29.66 |

|

salty and bound clay (2) |

Avg. |

3.47 |

56.81 |

16.35 |

|

salty and loess (14) |

Avg. |

5.09 |

10,813.64 |

2,126.25 |

|

total (42) |

Avg. |

4.45 |

– |

– |

|

Source: Our calculations based on the 1858 soil map and income data published in 1865. |

||||

By comparing the productivity of small and large estates located on the same soil types (Table 6), one can highlight the “soil-neutral” efficiency of the farm type. The combined query of the incomes (1865)—soil (1858) database revealed that in the case of loess, the large estates were clearly more efficient, while in the case of saline soils, the smallholdings were more efficient, obviously because the smallholder was forced to produce a minimum quantity even by investing extra work (and/or a larger workforce) to subsist, while the large farm was not under such pressure. In the case of settlements with mixed loess and saline soils, there was no significant difference between small and large farms.

Table 6. Differences in net cadastral income grouped by soil types and farm sizes (in forints, 1865)

|

Dominant soils |

Farm size |

Net cadastral income |

Net cadastral income |

|

sand |

MIXED estate structure (1) |

5.49 |

97.38 |

|

peat |

MIXED estate structure (2) |

2.38 |

103.25 |

|

loess |

DOMINANCE OF SMALLHOLDINGS (2) (79), cadastral acres |

4.67 |

370.32 |

|

DOMINANCE OF LARGE ESTATES (6) (4848 cadastral acres) |

6.32 |

30,645.59 |

|

|

TOTAL (8) |

5.91 |

23,076.77 |

|

|

saline |

MIXED estate structure (12) |

3.52 |

90.46 |

|

DOMINANCE OF SMALLHOLDINGS (1) (4 cadastral acres) |

4.06 |

36.79 |

|

|

DOMINANCE OF LARGE ESTATES (1) |

2.74 |

24,242.00 |

|

|

TOTAL (14) |

3.51 |

1,811.74 |

|

|

saline and soot |

(1) |

2.32 |

68.75 |

|

saline and clay |

MIXED estate structure (1) |

3.38 |

95.65 |

|

SMALLHOLDING DOMINANCE (1) |

3.57 |

17.97 |

|

|

TOTAL (2) |

3.47 |

56.81 |

|

|

saline and loess |

MIXED estate structure (6) |

5.53 |

183.82 |

|

SMALL FARMS DOMINANCE (3) (18 kh) |

4.52 |

83.67 |

|

|

LARGE ESTATES (5) (6122 kh) |

4.90 |

30,007.40 |

|

|

TOTAL (14) |

5,09 |

10,813.00 |

|

|

Source: Our calculations based on the 1858 soil map and income data published in 1865. |

|||

How did landowners manage to acquire good quality land? In order to answer this question, we superimposed the soil map from 1858 on the Harruckern map of land use in the 1780s, which also contained aggregated landuse and population data at the settlement level (unfortunately, it did not include yields). Our research has shown that around 1780, most of the land far away from rivers and covered with loess was used as pasture (Tables 7 and 8), which, as public property (communal land, which meant that both the landlord and the peasants had the right to use it), fell into the hands of the manor according to the laws of 1848. These areas, converted into ploughland as a result of the land-use change induced by grain hunger in Europe, which generated high prices, showed extremely high yields and high incomes in the mid-nineteenth century due to decades of fertilization and fallowing.

Water regulation works began here around 1865, so the statistics cited reflect the incomes of the pre-regulation situation, when plots on saline soils and peat were more exposed to water. This implicitly also meant that the water regulation work of 1865 generated a temporary ameliorating situation for the smallholders (although peat that has lost water is easily damaged by wind and compaction caused by trampling, so the improvements are only temporary). In contrast to the situation along the Körös River, in the Central Tisza region at the end of the eighteenth century the floodplains of the rivers were dominated not by small farms but by large estates and communal-public lands used as pastures and meadows for grazing. This all became manorial land after 1848. So, water regulation along the Tisza River favored large estates.

Table 7. Differences in land use types on different soils (%) and farm types in 1865

|

Soil type |

Smallholding / large holding ratio |

Arable (%) |

Meadow (%) |

Pasture (%) |

Woodland (%) |

Vineyard (%) |

Reed (%) |

Uncultivated |

|

|

sand IV |

1 |

138.17 |

65.84 |

4.33 |

25.16 |

0.00 |

1.54 |

0.00 |

3.13 |

|

peat III |

2 |

32.72 |

18.06 |

29.74 |

16.28 |

10.64 |

0.21 |

7.99 |

17.09 |

|

loess I |

8 |

17.39 |

60.37 |

19.04 |

17.02 |

0.39 |

0.16 |

0.00 |

3.01 |

|

saline II |

14 |

73.40 |

44.02 |

16.13 |

28.95 |

2.92 |

1.22 |

1.03 |

5.73 |

|

saline and sooty peat |

1 |

175.50 |

34.91 |

29.17 |

21.47 |

0.47 |

0.84 |

2.31 |

10.83 |

|

saline and clay, V |

2 |

141.83 |

37.98 |

12.40 |

31.62 |

3.86 |

3.17 |

0.42 |

10.55 |

|

saline and loess |

14 |

52.28 |

59.89 |

9.44 |

23.21 |

0.94 |

0.64 |

0.78 |

5.10 |

|

Total |

42 |

61.32 |

51.20 |

14.96 |

24.02 |

2.06 |

0.87 |

1.06 |

5.83 |

|

Source: Our calculations based on the 1858 soil map and the income data published in 1865 (area and income of Hungary by cultivation). The dominant land use pattern(s) have been highlighted by bold letters. |

|||||||||

Table 8. The land use and quality of the land (in 1858) that functioned as praedium (non-urbarial, non-peasant plots) in 1790

|

Praedium |

Soil quality |

Soil genetic type |

Arable |

Meadow |

Pasture |

Forests |

|

Kígyósapáti pr.41 |

2 |

saline |

0.00 |

4.76 |

95.24 |

0.00 |

|

Nagykondoros pr. |

1 |

loess |

0.00 |

0.00 |

100.00 |

0.00 |

|

Nagy Csákó |

1 |

loess |

0.00 |

0.00 |

100.00 |

0.00 |

|

Kis Csákó |

1 |

loess |

0.00 |

0.00 |

100.00 |

0.00 |

|

Csorvás dominale42 |

1 |

loess |

0.00 |

0.00 |

100.00 |

0.00 |

|

Csorvás comm. |

1 |

loess |

0.00 |

0.00 |

100.00 |

0.00 |

|

Eperjes pr. |

1 |

loess |

0.00 |

0.00 |

100.00 |

0.00 |

|

Szénás pr. |

2 |

saline |

0.00 |

0.00 |

100.00 |

0.00 |

|

Kis Kamut pr. |

1 |

loess |

100.00 |

0.00 |

0.00 |

0.00 |

|

Szt. Miklós pr. |

100.00 |

0.00 |

0.00 |

0.00 |

||

|

Csejti Pr. |

2 |

saline |

0.00 |

0.00 |

100.00 |

0.00 |

|

Bélmegyer pr. |

2 |

saline |

0.00 |

55.03 |

40.46 |

4.51 |

|

Gerla pr. |

3 |

peat |

0.00 |

44.48 |

44.48 |

11.04 |

|

Ölyved pr. |

3 |

peat |

0.00 |

73.61 |

24.51 |

1.88 |

|

Királyhegyes pr. |

loess |

0.00 |

12.27 |

87.73 |

0.00 |

|

|

Apáca pr. |

1 |

loess |

0.00 |

0.00 |

100.00 |

0.00 |

|

Tamás pr. |

2 |

saline |

0.00 |

40.20 |

24.87 |

34.93 |

|

Kis Péll pr. |

5 |

clayey |

0.00 |

24.97 |

75.03 |

0.00 |

The relationship between soil conditions and net cadastral land income can also be examined in 1910, since the genetic soil type can be considered a conservative property (at least for a span of 50 years), and the municipal net cadastral income is also available from 1883 and 1910 and even sorted even by type of land use. So, net income is available for different products (Table 9), which was not true of the survey done in 1865. The difference between loess-soils and clayey or salty solonetz soil is still remarkable, and estate size on loess remained extremely high in 1910.

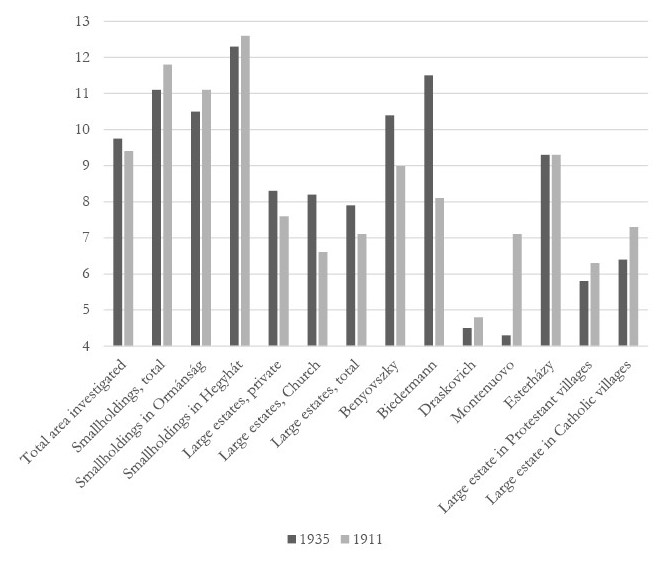

By 1935, the positive trends in the net cadastral income of smallholdings in the Pécs region (southern Hungary) mentioned earlier (Figure 4) had also changed. The net cadastral income per acre of small estates fell from almost twelve crowns in 1911 to less than eleven crowns, while that of large estates rose to over eight crowns, and on the Biedermann and Benyovszky estates, the net income per cultivated acre of land jumped from eight or nine golden crowns43 before World War I (Figure 6) to ten or eleven. This confirms that we have a spatially and temporally fluctuating phenomenon, which also depended on market volume, soil quality, and land use, in addition to technology and crop culture.

Figure 5. Overlay of the 1858 Békés-Csanád soil map with post-1886 settlement boundaries

Table 9. Differences in the net cadastral income per acre and per holding of settlements on different soil types, and the relationship between average holding size and soil type in 1910

|

Soil quality (settlements) |

Total net cadastral income, 1865 |

Total net cadastral income, |

Net cadastral income of woods |

Net cadastral income of grape K/acre |

Net cadastral income of ploughlands |

Net cadastral income of pastures |

Net cadastral income of meadows |

Average net cadastral income per one estate |

Average estate size (acre) |

|

clayey V (3) |

12.41 |

3.80 |

16.87 |

14.26 |

2.85 |

6.16 |

243.49 |

18 |

|

|

sand IV (3) |

11 (1) |

20.56 |

8.47 |

23.17 |

20.61 |

9.21 |

12.04 |

128.93 |

6 |

|

peat III (4) |

5 (2) |

11.83 |

7.27 |

15.17 |

13.30 |

5.03 |

11.13 |

203.13 |

17 |

|

peat and saline (4) |

4.5 (1) |

10.06 |

8.44 |

13.34 |

11.44 |

3.10 |

7.21 |

133.14 |

13,5 |

|

loess (34) |

12 (8) |

16.85 |

5.44 |

21.34 |

17.33 |

7.25 |

8.29 |

5,828.85 |

295 |

|

loess and saline (2) |

10 (14) |

19.19 |

9.63 |

22.82 |

22.17 |

7.95 |

9.40 |

329.68 |

19 |

|

saline II (21) |

7 (14) |

11.95 |

6.16 |

18.85 |

13.50 |

4.35 |

6.20 |

315.00 |

24 |

|

saline and loess I and II (14) |

10 (14) |

23.26 |

6.26 |

17.51 |

18.15 |

4.96 |

7.56 |

161.16 |

9,5 |

|

Total: 85 |

9 (42) |

16.09 |

6.25 |

19.23 |

16.10 |

5.74 |

7.68 |

2,405.99 |

125 |

|

* Calculated from forints. One forint = two kronen. Numbers in brackets indicate the number of settlements involved in the investigation in 1865. The sets of settlements in 1865 and 1910 are not identical, so any conclusions concerning changes in incomes should be handled with care. |

|||||||||

|

Source: Our calculations based on the 1858 soil map and Arad / Békés / Csanád vármegye adóközségeinek területe és kataszteri tisztajövedelme. |

|||||||||

Figure 6. Differences in the net cadastral incomes of small and large estates of different types in 1935, expressed in golden crowns. (Demeter and Koloh, “Birtokstruktúra és jövedelmezőség.”)

Socio-Economic Characteristics of Estate Types (1890s–1930s)

The question of profitability is therefore not settled by the series of studies summarized above. Income alone, however, does not necessarily offer a precise means with which to classify a settlement (or the type of enterprise that predominates) as developed or underdeveloped, since the concept of welfare includes a variety of other dimensions (health, environment, cultural indicators, etc.). And as a large part of the income generated in settlements that were dominated by large estates did not fall into the hands of the agrarian producers, this indicator is therefore inappropriate for comparisons of welfare. If we want to check or reproduce Miklós Móricz’s local-scale research for the whole country and investigate further the contradictory picture of large estates as either “oppressive” or “modern and profitable,” other social, economic and demographic factors must be taken into account in addition to cadastral income (which is more an indicator of farming quality than of livelihood).

The GISta Hungarorum database44 allows the reconstruction of the socio-economic-demographic conditions of the settlements dominated either by large estates or small farms for 1910. Since various indicators of development are also available (the Human Development Index, HDI at settlement level from 1910 calculated by Zsolt Szilágyi),45 it is also possible to determine whether there was a correlation between general development levels and farm type in 1910. For this purpose, we extracted a list of large farms from the compendium compiled by Gyula Hantos (1926)46 and the Farmers’ Inventory (1897). The former provides statistical data on large estate types within the post-1920 boundaries of Hungary. The latter makes the entire area of the historical country available for analysis from an earlier period, but using different criteria and classifications of large estates. The Farmers’ Inventory from 1935 provides further possibilities. First, it is possible to group the settlements according to the share of the large estates as a proportion of the total area of the given settlements, and second, it is possible to examine the difference in net cadastral incomes per acre between large estates and small farms in the 1920s, but only for the post-Trianon area of the state.47

Based on Hantos’ dataset from the 1920s (the postwar territory of Hungary) and the socio-economic indicators from the census of 1910, it was possible to distinguish aristocratic, non-aristocratic noble, ecclesiastic, etc. large estate types (above 100 acres), and one can also draw a distinction between large estates consisting mostly of arable land and large estates large estates consisting mostly of non-arable land. Using the socio-economic indicators from 1910, the several conclusions can be drawn, each of which I discuss below.

Natural reproduction rate (measured according to the proportion of the population under six years of age) was 1–2 percent higher on almost all types of large holdings than in the settlements dominated by smallholdings.48 The situation was reversed for the population aged 60 and over, with a higher proportion on smallholdings (eight percent versus nine percent). The proportion of elderly people was lower on large farms dominated by arable land, indicating a larger workforce (i.e. people belonging to the work force were usually younger). In 1910, literacy rates on large estates of the noble, feudal, aristocratic, and non-feudal types were one to two percent lower than on small estates. This constitutes a significant change from circumstances in 1880, when literacy rates in the settlements dominated by smallholdings were markedly lower compared to the values in large-estate dominated settlements. Indeed, over the course of those three decades, literacy rates in settlements dominated by smallholdings increased by five percent points. Almost all large estates had 50 percent higher per capita net cadastral income than settlements dominated by smallholders (which is not surprising). The reason for this difference in per capita income clearly lies in the differences in cadastral income per acre, which was significantly higher on the large estates (10.6 vs. 8.6 kronen) than in settlements dominated by smallholdings. Since the amount of land per agricultural earner (including day laborers) was also higher on large estates, the difference in income per earner could be more than 50 percent on most large estates compared to small estates (except for Church and state-owned large estates, where the difference was smaller). The net cadastral income per acre was higher even on the large holdings that were dominated by pasture than it was on the smallholdings.

Death rates were also higher on large estates, as were birth rates. Migration gains were clearly more significant on large estates, with values up to two to three times higher (Church and state-owned estates were the least preferred),49 and in 1910, migration still provided a means with which to address rural overpopulation. On large estates, the death rate from measles, dysentery, and whooping cough was lower.

In terms of distance from the railways, large estates were usually closer than small estates, and the proportion of smallholders compelled to work as day laborers was also higher on large estates (not surprisingly). The quality of housing, on the other hand, was uniformly worse on large estates. In this light, it is particularly noteworthy that mortality from diseases influenced by housing conditions (such as tuberculosis and the commonly prevalent diseases mentioned above) was still lower on these estates. This was probably due to better access to health services in settlements dominated by large estates. The proportion of deceased who had received some medical treatment was also higher on large landholdings.

Finally, the HDI value calculated by Zsolt Szilágyi50 for 1910 was also clearly better in the settlements dominated by large estates and was higher than the national average (Table 10). However, from the perspective of today’s development levels and patterns, there is no connection between the present status of a piece of agricultural land as part of a periphery or core and the locations of former large estates. This means that much has changed over the course of the past century. (High development values were recorded in 2016 on former large estates, where the abundance of arable land was moderate around 1920, i.e. 50-75 percent of the cultivated land).

Based on the 1897 Farmers’ Inventory (which included landowners with estates over 100 cadastral hold), we can draw conclusions for the whole country, not just for the post-Trianon area. Of the 12,600 settlements, 5,576 had no large landholdings and their complex development index was much lower than that of the settlements with large landholdings in 1910 (except the group of large estates less than 15 percent of which was arable land, i.e. they were dominated by forests or pasture). There was hardly any difference in the proportion of the population under six years of age in each group, and the same is true for the population over 60 years of age, in contrast to the results of our investigation using Hantos’ dataset for the “reduced” interwar area in 1926. However, literacy rates were significantly higher in settlements with large estates dominated by ploughland (the opposite was true for the post-1920 country study). The improvement in literacy rates between 1880 and 1910 showed no significant difference between estate types (this also differs from the result of the statistical evaluation of Hantos’ estate list for the post-1920 country), showing an overall improvement of 20 percent (compared to the 5 percent increase in literacy rates in settlements found in the territory of post-Trianon Hungary). The proportion of deceased persons who had received some form of medical treatment was higher on large estates than on small farms. The rate of illegitimate births was high in settlements dominated by forest holdings and was below the national average in settlements with large estates dominated by arable land. However, these two mentioned types of large holdings were the most unfavorable in terms of settlement level infant mortality in 1910.

Table 10. Characteristics of the socio-economic-demographic conditions in the settlements dominated by large estates in the statistics compiled by Hantos in 1926 on large estates (group averages)

|

Group |

Estate |

Population under 6 years 1910, % |

Population above 60 years 1910, % |

Over 60 years old / under 6 years old |

Average |

Average death rate, 1901–10 |

Average natural reproduction rate, 1901–10 |

Population increase rate, 1901–10 |

Average migration rate, 1901–10 |

Whooping cough, scarlet fever, measles as a % of |

Tuberculosis as a % of |

|

large estates of non-nobles |

33 |

17.27 |

8.32 |

0.50 |

37.86 |

24.04 |

13.82 |

74.77 |

60.96 |

3.86 |

16.17 |

|

aristocrats |

182 |

16.39 |

8.10 |

0.52 |

37.52 |

24.08 |

13.44 |

73.20 |

58.99 |

4.09 |

14.79 |

|

clerical |

51 |

16.28 |

8.83 |

0.57 |

38.33 |

25.43 |

12.90 |

63.61 |

50.71 |

4.36 |

14.53 |

|

state (urban) |

40 |

15.73 |

8.17 |

0.54 |

35.57 |

24.96 |

10.61 |

91.30 |

80.70 |

3.58 |

15.18 |

|

corporate |

3 |

19.37 |

4.98 |

0.26 |

41.34 |

21.12 |

20.22 |

68.17 |

47.95 |

6.00 |

11.91 |

|

foundation |

9 |

15.86 |

9.03 |

0.62 |

35.30 |

23.68 |

11.62 |

98.81 |

87.19 |

3.01 |

16.50 |

|

noble |

13 |

16.22 |

8.00 |

0.59 |

38.76 |

25.16 |

13.60 |

111.91 |

96.11 |

2.61 |

15.07 |

|

hereditary |

20 |

17.63 |

7.59 |

0.45 |

39.76 |

25.16 |

14.60 |

68.45 |

53.85 |

4.66 |

15.36 |

|

all large estates |

351 |

16.46 |

8.20 |

0.53 |

37.60 |

24.44 |

13.16 |

75.80 |

62.16 |

4.02 |

14.99 |

|

all municipalities of the country after Trianon |

3,392 |

15.74 |

9.03 |

0.62 |

35.78 |

23.63 |

12.15 |

44.64 |

31.82 |

4.74 |

16.25 |

|

settlements without large estates |

3,042 |

15.65 |

9.13 |

0.63 |

35.56 |

23.53 |

12.03 |

41.03 |

28.31 |

4.82 |

16.39 |

|

Group |

Settlement wealth per capita, 1908, K* |

Direct tax per capita, 1909, K |

Settlement income per capita, 1909, K |

Earners from population, %, 1910 |

Industrial earners from all earners, 1910, % |

Tertiary earner in %, 1910 |

Literate in 1910, % |

Literate in, 1880, % |

Increase in literacy rate (1880-1910) |

Average size of population 1910 |

|

large estates of non-nobles |

34.09 |

23.79 |

8.58 |

39.09 |

9.79 |

16.33 |

63.43 |

45.60 |

17.83 |

5,665.21 |

|

aristocratic |

29.72 |

20.20 |

7.35 |

39.27 |

11.25 |

15.36 |

64.84 |

44.84 |

20.01 |

5,100.73 |

|

clerical |

37.09 |

19.60 |

6.97 |

38.70 |

9.32 |

13.33 |

65.93 |

45.50 |

20.43 |

5,408.08 |

|

state (urban) |

46.29 |

10.76 |

4.19 |

41.37 |

17.58 |

27.70 |

66.96 |

49.17 |

17.79 |

41,761.78 |

|

corporate |

9.86 |

34.79 |

5.43 |

37.56 |

6.08 |

9.50 |

59.44 |

36.68 |

22.76 |

2,944.33 |

|

foundation |

41.73 |

23.45 |

6.23 |

40.09 |

9.12 |

14.18 |

67.15 |

51.70 |

15.45 |

9,236.22 |

|

noble |

46.74 |

19.95 |

8.36 |

38.00 |

10.07 |

12.38 |

64.09 |

43.41 |

20.68 |

4,462.31 |

|

hereditary |

19.96 |

24.50 |

6.25 |

38.07 |

9.27 |

15.62 |

61.83 |

44.43 |

17.40 |

4,368.45 |

|

all large estates |

33.30 |

19.82 |

6.98 |

39.30 |

11.30 |

16.39 |

64.92 |

45.53 |

19.39 |

9,398.59 |

|

all municipalities of the country after Trianon |

25.31 |

16.06 |

6.44 |

40.82 |

10.18 |

13.61 |

65.67 |

42.47 |

23.21 |

2,362.15 |

|

settlements without large estates |

24.38 |

15.63 |

6.37 |

40.98 |

10.05 |

13.28 |

65.74 |

42.10 |

23.64 |

1,549.47 |

|

* Kronen |

||||||||||

|

Group |

Smallholders compelled today laborers %, 1910 |

Cadastral income / agr. earner |

Cadastral income/capita (K, 1910) |

Cadastral income per acre (K, 1910) |

Cadastral income per estate |

Average estate size |

Average estate size per one agr. earner |

Direct tax / cadastral income in 1910 |

|

large estates of non-nobles |

64.32 |

146.00 |

32.76 |

12.78 |

467.44 |

31.81 |

11.64 |

0.73 |

|

aristocrats |

62.01 |

125.54 |

28.70 |

10.47 |

1945.19 |

275.39 |

12.35 |

0.70 |

|

clerical |

62.17 |

95.39 |

25.05 |

9.61 |

124.52 |

12.74 |

9.66 |

0.78 |

|

state (urban) |

59.47 |

96.31 |

18.88 |

10.14 |

4776.94 |

247.35 |

10.37 |

0.57 |

|

corporate |

43.98 |

258.43 |

32.44 |

11.11 |

5986.46 |

430.17 |

20.42 |

1.07 |

|

foundation |

58.01 |

127.40 |

33.31 |

12.00 |

263.55 |

21.74 |

10.75 |

0.70 |

|

noble |

63.16 |

106.85 |

30.42 |

9.92 |

158.80 |

16.85 |

11.02 |

0.66 |

|

hereditary |

60.43 |

159.60 |

31.05 |

10.93 |

1222.40 |

91.68 |

14.60 |

0.79 |

|

all large estates |

61.66 |

122.18 |

27.78 |

10.57 |

1757.26 |

186.64 |

11.77 |

0.71 |

|

all municipalities of the country after Trianon |

62.98 |

77.69 |

21.75 |

8.82 |

239.51 |

28.61 |

9.85 |

0.74 |

|

settlements without large estates |

63.12 |

72.53 |

21.04 |

8.62 |

64.30 |

10.37 |

9.62 |

0.74 |

|

Group |

Deaths, receiving medical treatment (1=100%) |

Share of persons involved in home industry to total population, 1910 |

Infant mortality measured to deaths, avg. of 1901–1910 (1=100%) |

Houses of bad quality material in 1910 (1=100%) |

HDI in 1910 (Szilágyi 2019) |

Territorial development index in 2010- |

Distance from nearest railway station (m, 1890) |

|

large estates of non-nobles |

0.86 |

0.002 |

0.33 |

0.64 |

0.42 |

0.524 |

14,226 |

|

aristocrats |

0.76 |

0.002 |

0.34 |

0.54 |

0.41 |

0.548 |

9947 |

|

clerical |

0.74 |

0.001 |

0.32 |

0.68 |

0.41 |

0.576 |

14,138 |

|

state (urban) |

0.87 |

0.002 |

0.31 |

0.54 |

0.43 |

0.616 |

7891 |

|

corporate |

0.76 |

0.003 |

0.39 |

0.51 |

0.44 |

0.479 |

18,282 |

|

foundation |

0.88 |

0.002 |

0.31 |

0.70 |

0.42 |

0.531 |

9542 |

|

noble |

0.73 |

0.001 |

0.36 |

0.81 |

0.40 |

0.544 |

8090 |

|

hereditary |

0.81 |

0.002 |

0.35 |

0.57 |

0.43 |

0.518 |

12,291 |

|

all large estates |

0.78 |

0.002 |

0.33 |

0.59 |

0.41 |

0.588 |

10,850 |

|

all municipalities of the country after Trianon |

0.48 |

0.002 |

0.32 |

0.46 |

0.38 |

0.568 |

11,768 |

|

settlements without large estates |

0.44 |

0.002 |

0.32 |

0.45 |

0.38 |

11,870 |

Settlement wealth per capita was also high for large estates over 75 percent of which was arable land, as was the value of direct taxes. This was similar for “smaller” large estates under 500 acres. Municipal incomes per capita were similar in all categories, except for large estates over 75 percent of which was arable land, where we find an outlier value. Large estates over 75 percent of which was ploughland and those with over 1,000 acres had higher birth rates, while there was no difference in the death rates between estate types. However, migration rates were high towards settlements with large estates dominated by forest and grassland and estates that were over 1000 acres, while in settlements with large estates dominated by arable land the rate of population growth from migration was below the national average. The death rates from scarlet fever, measles, and whooping cough were particularly high in settlements with large holdings dominated by pasture and forests and on large holdings under 500 acres, exceeding the average measured for villages dominated by smallholdings. (Again, this contradicts the results of the earlier study on a narrower area, suggesting that the difference is not really due to the size of the estate but to other, natural geographic and cultural causes, as was true in the case of the contrast regarding literacy described above.) In the case of tuberculosis, however, there was no such remarkable difference. The share of industrial earners was significant on extremely large estates and large estates dominated by pasture, forest, and ploughland, two percentage points above the share measured in settlements dominated by small estates. Large estates dominated by ploughland and estates over 1,000 acres were four and a half kilometers closer to railway stations than small estates (again excluding large estates dominated by forest and grassland).

Table 11. The socio-economic and demographic development conditions in 1910 in the settlements dominated by the large estates on the basis of the 1897 Farmers’ Inventory compared with the situation in settlements dominated by small farms

|

Large estate |

Case number (settlements) |

Composite development indicator of Demeter, 1910 |

Population below 6 years, 1910 % |

Population above 60 years, 1910, % |

Literacy rate, 1910, % |

Increase in literacy in %, 1880–1910 |

Settlement wealth per capita in K, 1909 |

Direct tax per capita in K, 1909 |

|

under 500 kh* |

2,215 |

0.407 |

16.017 |

9.010 |

50.505 |

21.908 |

35.400 |

12.143 |

|

500–1000 kh |

1,308 |

0.719 |

16.293 |

8.703 |

53.434 |

22.551 |

30.277 |

14.214 |

|

above 1000 kh |

3,559 |

0.995 |

16.190 |

8.347 |

56.065 |

21.998 |

28.373 |

15.274 |

|

average of all large estates |

7,082 |

0.760 |

16.155 |

8.620 |

53.840 |

22.072 |

30.922 |

14.099 |

|

average of all settlements |

12,658 |

0.513 |

16.022 |

8.814 |

51.554 |

21.774 |

30.760 |

12.836 |

|

all settlements without large estates |

5,576 |

0.200 |

15.850 |

9.060 |

48.650 |

21.400 |

30.550 |

11.230 |

|

* Cadastral acre = 5570 m2. |

||||||||

|

Large estate |

Birth rate, avg. of, 1901–1910 |

Death rate, |

Natural increase avg. of |

Total increase, avg. of, |

Migration rate, avg. of |

Measles, scarlet fever, whooping cough as a % of total deaths, 1901–1910 |

Tuberculosis as a % of total deaths, |

|

under 500 kh |

36.167 |

24.512 |

11.655 |

35.733 |

23.711 |

7.045 |

13.800 |

|

500–1000 kh |

36.811 |

24.262 |

12.549 |

35.840 |

23.521 |

6.742 |

14.186 |

|

above 1000 kh |

37.121 |

24.635 |

12.487 |

52.561 |

39.432 |

5.757 |

14.758 |

|

average of all large estates |

36.765 |

24.527 |

12.238 |

44.209 |

31.576 |

6.342 |

14.353 |

|

average of all settlements |

36.193 |

24.496 |

11.697 |

39.473 |

27.664 |

6.552 |

14.243 |

|

all settlements without large estates |

35.470 |

24.460 |

11.01 |

33.460 |

22.700 |

6.820 |

14.100 |

|

Large estate |

Agrarian earners from all earners, %, 1910 |

Industrial earners, %, 1910 |

Acre per 1 agrarian inhabitant, |

Smallholders compelled to do daily labor for wages, 1910, % |

Net cadastral income/capita, 1910, K |

Direct tax/net cadastral income, 1910 |

Net cadastral income on 1 cultivated acre, 1910, K |

|

under 500 kh |

80.28 |

8.54 |

4.675 |

63.83 |

14.87 |

1.043 |

5.927 |

|

500–1000 kh |

78.17 |

9.13 |

4.720 |

62.49 |

18.40 |

0.992 |

7.210 |

|

above 1000 kh |

73.16 |

11.35 |

5.059 |

63.13 |

20.16 |

0.967 |

7.774 |

|

average of all large estates |

76.31 |

10.06 |

4.876 |

63.23 |

18.18 |

0.995 |

7.092 |

|

average of all settlements |

78.06 |

9.32 |

5.051 |

65.69 |

15.73 |

1.096 |

6.230 |

|

all settlements without large estates |

80.29 |

8.39 |

5.270 |

68.81 |

12.62 |

1.23 |

5.14 |

|

Large estate |

Literacy rate in %, 1880 |

Distance from railway station (m) 1890 |

Decrease in distance from railway station, 1890-1910 |

Population dealing with home industry from total population (1=100%) |

Deceased receiving medical treatment, 1910 (1=100%) |

Illegitimate births, avg. of 1901-1910 (%) |

Infant mortality from deaths, avg. of 1901-1910 (1=100%) |

Average estate size in acre, 1910 |

|

under 500 kh |

28.596 |

16358.1 |

7559.2 |

0.003 |

0.314 |

8.649 |

0.294 |

11.128 |

|

500–1000 kh |

30.883 |

14662.1 |

6384.2 |

0.003 |

0.359 |

8.743 |

0.303 |

12.031 |

|

above 1000 kh |

34.068 |

13494.4 |

6280.5 |

0.003 |

0.487 |

9.475 |

0.312 |

34.375 |

|

average of all large estates |

31.768 |

14605.7 |

6699.6 |

0.003 |

0.409 |

9.081 |

0.305 |

23.013 |

|

average of all settlements |

29.782 |

15689.2 |

7141.4 |

0.003 |

0.345 |

9.000 |

0.298 |

22.343 |

|

all settlements without large estate |

27.260 |

17065.4 |

7702.6 |

0.000 |

0.260 |

8.900 |

0.290 |

21.490 |

Table 12. The value of socio-economic-demographic indicators (1910’s census) in the sub-groups of the large landholding population, based on the categorizations used in the Farmers’ Inventory (Gazdacímtár) in 1935

|

Estate type by size in acre (settlement number in brackets) |

Settlement size (population), 1910 |

Average |

Population under 6, 1910 (1=100%) |

State tax per capita |

Crude |

Literacy rate in 1910 among population above 6 years, % |

HDI 1910 (Szilágyi, Zsolt, 2019) |

Composite development in 1910 (composed of the single variables used here) |

|

under 500 acres (502) |

900.664 |

0.024 |

0.160 |

7.177 |

23.283 |

78.275 |

0.382 |

1.214 |

|

above 500 acres (1969) |

3267.898 |

0.024 |

0.147 |

13.012 |

24.045 |

77.125 |

0.387 |

1.379 |

|

fragment (275) |

1103.306 |

0.022 |

0.161 |

7.092 |

23.464 |

78.143 |

0.380 |

1.104 |

|

All settlements’ value |

2611.682 |

0.024 |

0.149 |

12.388 |

23.845 |

77.440 |

0.385 |

1.321 |

|

Estate type by size in acre (settlement number in brackets) |

Average cadastral income of |

Average cadastral income of large estates per acre, 1935, aK |

Proportion of estates under 1 acre, 1935 (1=100%) |

Proportion of estates over 100 acre, 1935 (1=100%) |

Average size of all estates inc. large landholdings (kh) |

Total cadastral income of ALL estates in 1935, aK |

Total cadastral income of smallholdings in 1935, aK |

Cadastral income of smallholdings per acre in 1935, aK |

|

under 500 acres (502) |

2058.86 |

7.169 |

0.232 |

0.422 |

1409.34 |

11305 |

9100 |

7.299 |

|

above 500 acres (1969) |

18,926.28 |

6.643 |

0.262 |

0.600 |

5519.81 |

47914 |

27,483 |

6.184 |

|

fragment (275) |

262.19 |

7.534 |

0.277 |

0.197 |

1237.12 |

11149 |

10,829 |

4.935 |

|

All settlements’ value |

14,047.96 |

6.830 |

0.258 |

0.526 |

4317.04 |

37281 |

22,403 |

6.264 |

|

* Golden crowns instead of pengő to make data comparable with that in 19 |

||||||||

The share of smallholders compelled to work as day laborers approached the high value typical for smallholding villages only in the type of large holdings that were predominantly pasture. This may have been due to the fact that on the large holdings that were predominantly ploughland and on extensive large holdings landless day laborers were often the majority of the work force. Net cadastral income per capita was more significant on large holdings than on smallholdings (except for the large estates dominated by pasture or forests), supporting the notion that large holdings were more productive (though this still does not include data on livestock). For large holdings of over 1,000 acres 75 percent of which were ploughland, net cadastral income per acre was also notably high.

The significance of the 1935 Farmers’ Inventory for the present investigation (as well as the inventory from 1910, which we did not use here) is that it allows us to determine the productivity of small farms. By aggregating the total area and total income of large farms by settlement given in the inventory and subtracting these values from the total income and total area of settlements published by the Central Statistical Bureau in 1935 we can calculate the unpublished cadastral income data for smallholdings. In addition, it is also possible to create groups based on the proportion of large holdings (as a percent of area) per settlement and calculate the socioeconomic indicators for these subsets, within the post-1920 state boundaries.

The share of large landholdings as a percentage of total cultivated land in 1935 was analyzed in the following subgroups: above 60 percent, 40 percent-60 percent and 20 percent-40 percent. 1,970 settlements had large estates of over 500 acres (a share usually higher than 60 percent of the total cultivated land of the settlements), 500 settlements had large estate(s) between 100 and 500 acres, and 275 settlements had only large estate fragments under 100 acres (here the share of large estates was usually less than 20 percent of the total cultivated land). Some 600 settlements had no large holdings at all on their administrative area. To sum it up, in 1935, 56 percent of the settlements had a landholding of over 500 acres on their territory (Table 12).